Colorado REALTOR® Organizations Seek Clear Answers to “What is a Metro District?”

The number of metro districts in Colorado has increased by over 70 percent in the last decade, raising questions in the real estate industry. How do metro districts impact housing costs for homebuyers?

Commissioned by the Fort Collins Board of REALTORS®, Greeley Area REALTOR® Association, Longmont Association of REALTORS® and Loveland-Berthoud Association of REALTORS®, This first-of-its-kind study explores this question.

Metro Districts in Colorado

The Anderson Economic Group was commissioned to analyze the impact of metro districts during the home buying and home selling process. This infographic provides a quick summary of the study’s results

Metro District Impacts on Housing Costs Report Summary

Commissioned by the Fort Collins Board of REALTORS®, Greeley Area REALTOR® Association, Boulder/Longmont Association of REALTORS®, and Loveland-Berthoud Association of REALTORS®, AEG analyzed the impact of metro districts on housing costs across ten districts in Metropolitan Denver and Northern Colorado. AEG’s analysis compared housing costs for a typical home in each district to what housing costs would have been if the same home was built outside of a metro district.

Metro District Impacts on Housing Costs

A growing number of new homes built in Colorado are being built in metro districts. Metro districts

are governmental entities that have the authority to issue debt and levy property taxes to repay

outstanding debt. Developers that build new subdivisions often form these districts to issue bonds

to cover a new subdivision’s infrastructure costs. The metro district then levies property taxes on

homeowners in the district to repay the debt. The proliferation of these districts has led to

increased scrutiny over the impact that districts have on housing costs.

AEG analyzed the impact of metro districts on housing costs across ten districts in Metropolitan

Denver and Northern Colorado. AEG’s analysis compared housing costs for a typical home in each

district to what housing costs would have been if the same home was built outside of a metro

district.

Metro districts present home buyers with cost trade-offs. Metro districts offer home buyers lower

up- front costs in exchange for higher housing costs over the long term. The metro districts AEG

reviewed reduced the amount needed for a 20% down payment by an average of 4% ($5,800) per home,

since shared infrastructure costs are not capitalized into metro district home sales prices. If

these same homes had been built outside of metro districts, infrastructure costs would have been

included in the home’s selling price, making the home more expensive.

However, metro districts also levy higher property taxes on homeowners in order to repay the debt

they issue. These property taxes typically result in higher long-term housing costs compared to

non-metro district homes. The districts AEG reviewed saw an average increase in long-term housing

costs of 2% ($16,200) over 30 years. This trade-off may appeal to some buyers for whom saving enough

for a down payment may be a challenge

When metro districts fail to make scheduled debt payments, homeowners pay higher costs. In metro

districts where homes are not built or sold as quickly as planned, districts may not generate

enough prop- erty tax revenue to pay down the debt they issue. This unpaid debt can accrue

additional interest and increases the amount home owners must pay to the metro district. AEG found

that two of the ten districts reviewed were not currently meeting their debt obligations. AEG

estimates that homeowners’ long-term housing costs in these districts will be 7% ($50,000) higher

on average than if those homes were built and sold outside of a metro district.

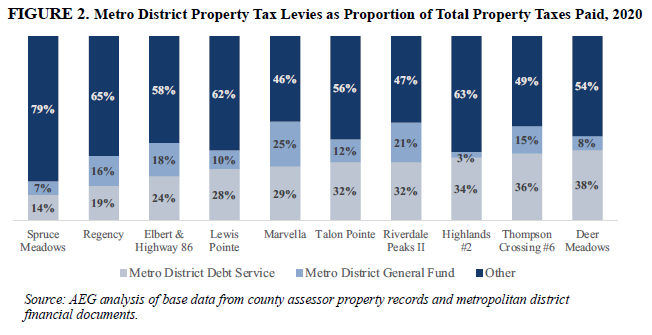

Metro district property taxes could take homeowners by surprise. In 2020, debt service property

taxes constituted 28% of the average tax bill in the metro districts AEG studied. The typical metro

district tax payment increased by 10% per year during the first four years of homeownership. These

rapidly-rising costs may place increased financial pressure on home owners in each district. AEG

found no evidence that these costs have led to higher foreclosure rates or depressed home values in

these districts.

Metro district best practices. County and municipal governments can reduce risks to homeowners by

carefully scrutinizing proposals to form new metro districts and denying those applications with

overly aggressive development schedules. Local governments should also utilize their oversight in

existing dis- tricts by monitoring the financial health of districts in their jurisdictions.

Policymakers should consider requiring developers to disclose a metro district’s debt service

schedule and anticipated future property tax liability to prospective home buyers as early as

possible in the transaction process in order to educate buy- ers about the risks and ramifications

of buying a home in a metro district.

About the Study’s Author. Anderson Economic Group is a research and consulting firm specializing in

economics, public policy, finance, business valuation, and industry analysis. The firm has offices

in East Lansing, Michigan and Chicago, Illinois.

For more information on metro district impacts, see the full report, “The Impact of Metropolitan

Districts on Housing Costs in Colorado,” March, 2021.