In recent years, both the metro Denver area and northern Colorado has tended to be the strongest labor markets and real estate markets in the state. This has been especially true in Larimer county where unemployment has been low and rent growth has been high. Greeley, which serves as a bedroom community to both the Denver area and the Ft. Collins-Loveland area has benefited as well. Below, I examine some recent regional statistics related to home prices and foreclosures.

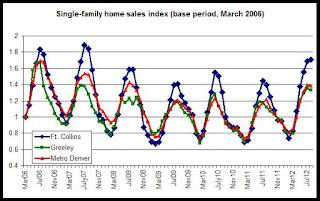

Home sales were up 22 percent in August 2012 in Ft. Collins compared to August 2011, and sales were up 18 percent in Greeley. The median home price was up 14 percent in metro Denver during the same period. There were 304 home sales in Ft. Collins during August 2012 and 339 home sales in Greeley during the same period. During August 2011 there were 248 sales in Ft. Collins and 286 sales in Greeley. The first graph shows that home sales have been slowly drifting up in all three regions since 2009. (Totals have been indexed for comparison purposes.) Since 2009, Greeley and metro Denver have followed the same pattern in sales, but both remain below 2008 index levels. Ft. Collins sales totals, on the other hand, have topped 2008 levels are are approaching 2007 peak levels reiterating that Ft. Collins has one of the strongest home sales markets in the state.

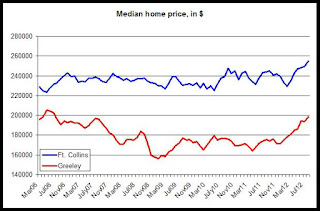

The second graph shows the median home prices in Ft. Collins and in Greeley, measured in dollars. Not surprisingly, Ft. Collins has higher home prices than Greeley, and Ft. Collins prices are now at an all time high while Greeley prices are still returning to peak levels from 2006. During August 2012, the median home price in Ft. Collins was $255,000 while the median price in Greeley was $198,000. The median home price metro Denver during August was $264,000. This data is based on median home price data released by the Colorado Association of Realtors (CAR).

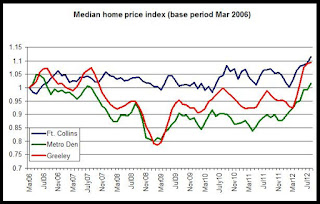

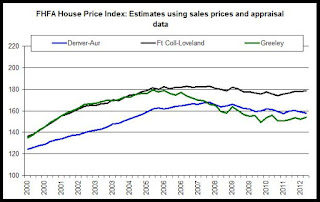

The third graph shows the trends in median home prices compared in the three regions. Both Ft. Collins and the Denver area are at all-time highs while the Greeley area remains below its 2006 peak. Ft. Collins home prices have outpaced both metro Denver and Greeley since 2006 and the Greeley area stagnated during 2009 and 2010, but has begun to show significant growth during 2012. Interestingly, Ft. Collins never showed the large decline in prices during 2008 that all other metro regions showed. The home price index is still down in Greeley from the May 2006 peak, but has nearly closed the gap.

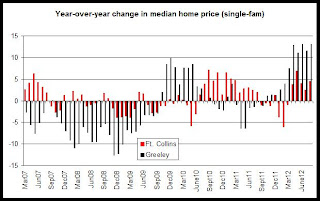

Although home prices remain below peak levels in Greeley and median home prices are below that found in Ft. Collins, growth rates in recent months in Greeley home prices have been quite large. Year-over-year growth in the median home price has exceed 10 percent for each of the past five months and has been positive for the past eleven months. Ft. Collins growth has not been as strong but has been generally positive since the summer of 2010. From August 2011 to August 2012, the median home price increased 4.4 percent in Ft. Collins, 13 percent in Greeley and 10.6 percent in metro Denver.

The Federal Housing and Finance Agency’s House Price Index further confirms that Ft. Collins prices are strong, although the Greeley prices in the FHFA index are weaker than those found in the CAR data. The fifth graph shows that home prices in Greeley and Ft. Collins were sharing a similar trend until 2006 when Greeley prices began to fall substantially and fell below both Ft. Collins and metro Denver prices. Ft. Collins prices, however, are nearly back up to peak levels in the FHFA data.

Even considering the more pessimistic FHFA data, the home price situation in Greeley appears to have stabilized after several years of significantly lowered prices. This is especially true when compared to Ft. Collins and metro Denver where prices have been more resilient.

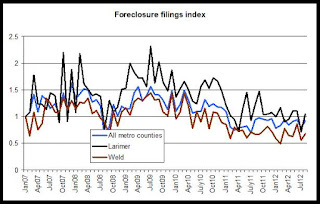

The sixth graph shows foreclosure filings in Weld County, Larimer County, and for all metro counties combined. Unlike comparisons with Mesa County, for instance, which show very different trends between Mesa County and all metro counties, the trend in foreclosure filings in Weld and Larimer counties is largely the same as all metro counties combined. Filings declined significantly during 2009 and 2010 and have flattened out since 2011. Totals nevertheless continue to decline from peak levels. There were 105 filings in Larimer County during August 2012 and 150 filings in Weld County during the same period. Back during August 2010, there were 169 filings in Larimer County and 255 in Weld County. Foreclosure filings have fallen by about 40 percent in both counties since 2010.

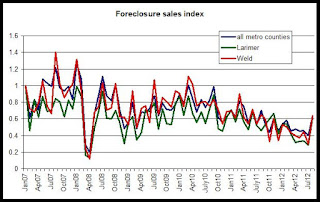

The final graph shows that the trend in foreclosure sales at auction are also largely the same when Weld County, Larimer County and metro totals are compared. Larimer county has tended to show the least amount of growth in foreclosure auction sales since 2007, while Weld County’s growth has tended to outpace the other regions. These differences are not large, however. Overall, foreclosure sales at auction are clearly down in all three regions over the past three years. There were 69 sales in Larimer County and 114 in Weld County during August 2012. During August 2010, though, there were 81 sales in Larimer County and 135 in Weld county, which are drops of 15 percent in two years in both counties.

Source: Colorado Division of Housing